Union Budget 2023: Chimney's Duty Up While Lab-Grown Diamond Duty Down

07 February 2023

On 02 February 2023,

the Indian government announced the Union Budget of 2023. The announcement administered

several important implementations and proposals in the country for the economic

development of India, and to boost local manufacturing. The proposed budget

announced the customs duties on imported goods, also known as tariffs, have

received changes. The import duties on electric kitchen chimneys, lab-grown

diamond seed, and imitated jewellery with other products received updates.

Electric Kitchen Chimney Duty Increased

The exemption from

the custom duty on the electrical kitchen chimney was reduced. The electrical

kitchen chimney was made expensive to import, as the import duty on the

commodity increased from 7.5% to 15%.

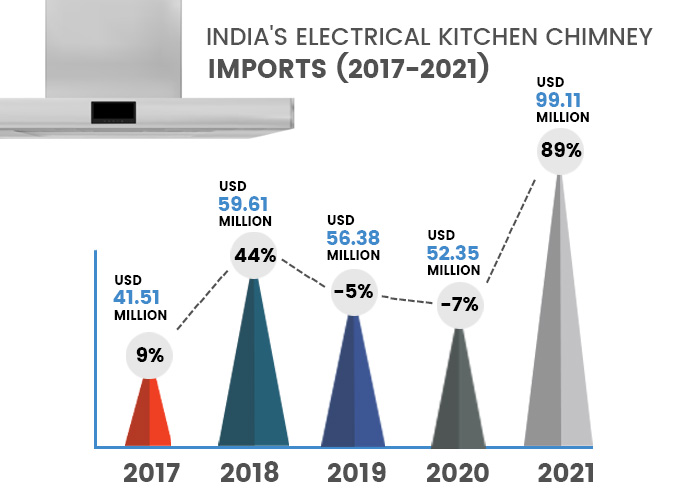

The below-shown data

represents the imports of electrical kitchen chimneys in India in the past 5

years with the respective growth value of each year. The data is shown on the

basis of HSN classification i.e., Subheading 841460.

|

India's Electrical

Kitchen Chimney Imports (2017-2021) |

||

|

Year |

Value USD Million |

Growth Value % |

|

2017 |

41.51 |

9 |

|

2018 |

59.61 |

44 |

|

2019 |

56.38 |

-5 |

|

2020 |

52.35 |

-7 |

|

2021 |

99.11 |

89 |

The import data for electrical

kitchen chimney shows the growth value of each year, starting from 2017 to

2021. The growth value in 2017 registered a minor growth value of 9% as the

value of 2016 amounted to $38.23 million and 2017 amounted to $41.51 million.

The growth in the

imports for the commodity in India registered the highest surge in 2021 as it

shows an 89% growth value. While due to the pandemic, the demand and production

were both affected, showing a -7% of growth value.

Import duty increase

will cause a decline in the imports of chimneys while boosting the

manufacturing of kitchen appliances domestically through imports of raw

materials. It implies that the kitchen ware industry might see a boost in the

value as exports will increase with increase in the production units.

Seeds of Lab-Grown Diamonds Duty Reduced

The proposal on the

reduction of the customs duty of imported seeds to sown lab-grown diamonds has

come across as a big decision by the Indian government. Extracting natural

diamonds is an expensive and extensive process that is becoming increasingly

difficult.

The threat of deposit

depletion in natural diamonds has caused a significantly higher rise in the

cost of the extraction process. The industry of gems has found lab-grown

diamonds to be a better alternative, as LGDs are grown inside a lab with the

help of technology.

The proposed budget

put a light on the significance of India in the diamond industry by stating

that India is a global leader in cutting and polishing diamonds from natural

resources, further adding that India contributes about three-fourths of the

worldwide diamond turnover by value.

The lab-grown

diamonds are made from seeds made of the same carbon as natural diamonds. Reduced

customs duty on the imports of these seeds will allow India to grow more

diamonds domestically and boost the demand among consumers—both locally and

globally.

Due to the shift in

the diamond industry from utilizing natural resources to using seeds, the

demand for LGDs will increase, causing the prices to go higher. Industry

experts claim that it will be a beneficial move for India and the diamond

industry, pushing synthetic diamonds exports up.

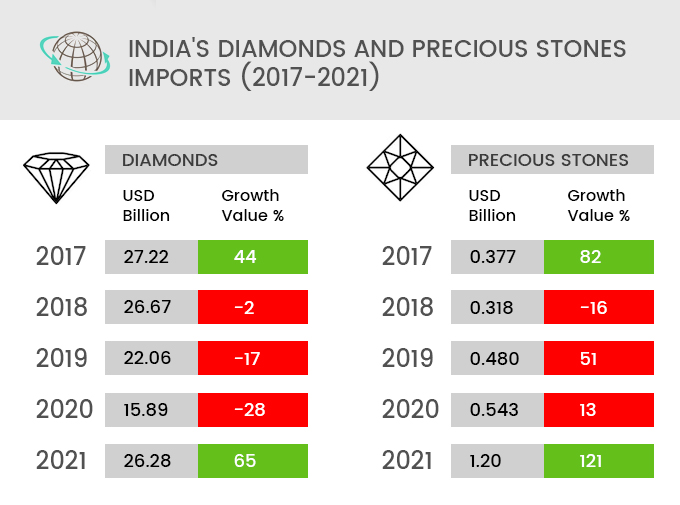

Below represented

data features the yearly values of diamonds imported by India in the past 5

years, along with each year’s growth value. The HSN Code used for the

representation of each commodity in the following dataset is—7102 for Diamonds and 7104 for

Precious Stones.

|

India's Diamonds

and Precious Stones Imports (2017-2021) |

||||

|

Year |

Diamonds |

Precious Stones |

Diamonds |

Precious Stones |

|

2017 |

27.22 |

0.377 |

44 |

82 |

|

2018 |

26.67 |

0.318 |

-2 |

-16 |

|

2019 |

22.06 |

0.480 |

-17 |

51 |

|

2020 |

15.89 |

0.543 |

-28 |

13 |

|

2021 |

26.28 |

1.20 |

65 |

121 |

|

|

Value USD Billion |

Growth Value % |

||

The import data above

shows that the demand of diamonds went down slightly in 2018 as growth value

went down by 2%. The growth value went on to decline till 2020, recording the

highest negative growth (28% in 2020), followed by the highest growth in 2021 (65%).

The growth value of

precious stones shows much higher values than diamonds. Followed by a growth

value of 82% in 2017, 2018 registered a downfall of 16%. In the years after

2018, precious stones didn’t register a negative growth and had the highest growth

in 2021 (121%).

Changes In Custom Duty Of Jewellery Imports

The other line of

commodities related to jewellery that have received changes in their customs

duty are gold, silver, platinum and imitation jewellery. While the duty on the

seeds for lab-grown diamonds was reduced per the proposal, the duty on

mentioned commodities has increased.

The budget also

brought the proposal to increase the customs duties on the imports of articles

made from gold and platinum. The import duty on silver dore, bars, and articles

was also increased. This change will bring the imports down of silver, gold,

platinum, and their articles.

The official figures

on the changes in the customs duties are yet to be published by the Government

of India. Still, according to online sources, there has been an increase in the

import duties on articles made of precious metals.

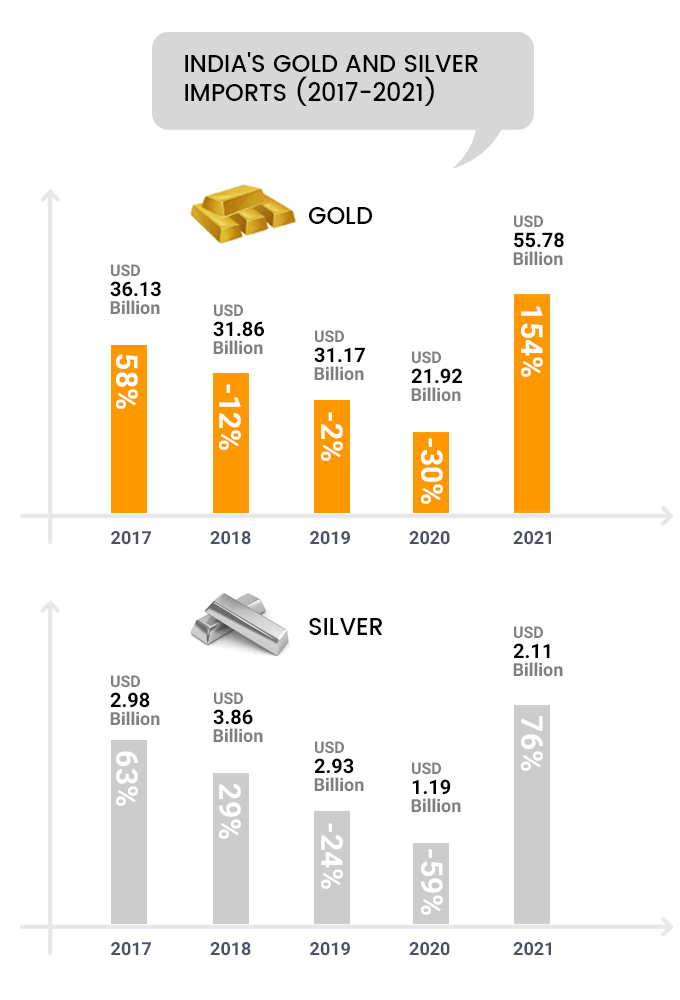

Customs duty on gold bars increased from 20% to 25%, and duty on silver bars increased to 5% from 2.5%. The import data represented below features the yearly values with a growth chart of the imported gold and silver in the past five years for HSN Codes – 7106 (Silver), and 7108 (Gold).

|

India's Gold and

Silver Imports (2017-2021) |

||||

|

Year |

Silver |

Gold |

Silver |

Gold |

|

2017 |

2.98 |

36.13 |

63 |

58 |

|

2018 |

3.86 |

31.86 |

29 |

-12 |

|

2019 |

2.93 |

31.17 |

-24 |

-2 |

|

2020 |

1.19 |

21.92 |

-59 |

-30 |

|

2021 |

2.11 |

55.78 |

76 |

154 |

|

|

Value USD Billion |

Growth Value % |

||

The growth of silver

imports in 2017 and 2018, as compared to the values of gold, registered

significant positive growth, despite the high difference between the market

value between both.

It is to be noted that the trends in the import values give a crucial indication of the demand.

In 2018, silver

registered the highest import value of $3.86 billion. The imports of gold were

registered as the highest in 2021 for an amount of $55.78 billion. However,

both of the precious metals registered the highest growth in 2021 (76% for

silver and 154% for gold).

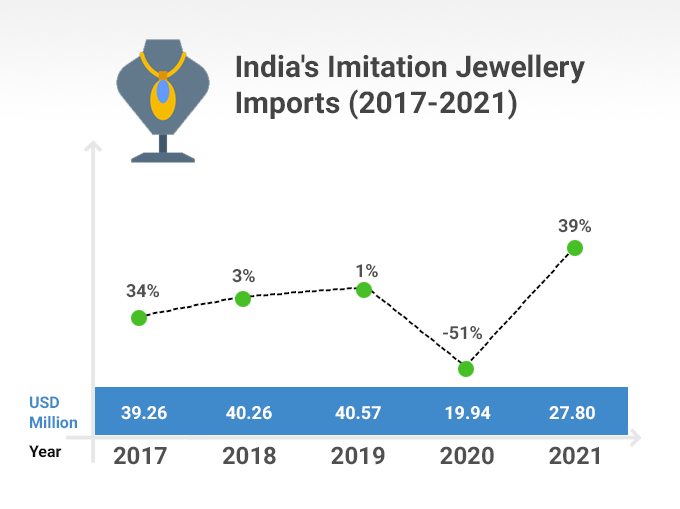

As per online

sources, the duty on the importation of imitation jewellery also increased, reaching

from 22% to 25%. The below-represented data shows the imports of the

commodities by India in the past five years for the HSN Code – 7117 (Imitation

Jewellery).

|

India's Imitation

Jewellery Imports (2017-2021) |

||

|

Year |

Value USD Million |

Growth Value % |

|

2017 |

39.26 |

34 |

|

2018 |

40.26 |

3 |

|

2019 |

40.57 |

1 |

|

2020 |

19.94 |

-51 |

|

2021 |

27.80 |

39 |

The growth value of

the imitation jewellery imports in the past five years shows vigorous

fluctuation. In 2017, the imports registered a growth of 34%, followed by minor

variations in the growth of 3% in 2018 and 1% in 2019. 2020 registered a sudden

negative growth which is also the highest in the past five years, followed by

the highest positive growth of 39% in 2021.

The increase in the

customs duties for the importation of all the aforementioned commodities will

cause a decrease in imports and an increase in domestic production. This will

boost the industry’s manufacturing units and an eventual domestic demand for

the commodities.

The announcement of

the proposals for changes in customs duties will increase the Indian economy by

allowing domestic manufacturers to make products domestically, and chances of

bolstering exports and increased trade relationships with other countries in

the future.