How the Gas and Oil Industry Fostering Innovation in A Volatile Market?

27 March 2024

For a generation, the Mineral

fuels, Products and Gas Industry played a key role in framing the core pillars

of the economy to build the base for lasting development. From home appliances

to industries, vehicles to cargo, and Air travel to Railways, almost every

sector of the economy is heavily dependent on this industry.

But the winds of the pandemic,

geopolitical tension along with climatic change and technological advancement

have drastically affected the Oils and Gas industry worldwide. Further the commitment

to carbon neutralization along with the Paris Agreement, Industries are

diversifying the production units based on petrochemical sources of energy to

renewable energy sources.

Through this blog, we’ll

explore how these factors impact the industry’s stability and introduce

opportunities amid challenges that can help companies make strategic decisions

for further expansions.

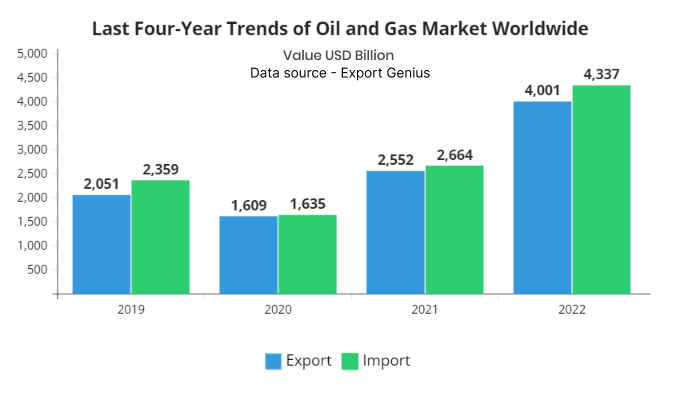

If you look at the trade data

taken from the Export Genius platform shows, the market size increased by two

folds from 2019 to 2022. During the pandemic, the export value drastically fell

by USD 442 billion from the previous year. The highest-ever growth in export

and import witnessed after 2021, export increased by USD 1449 billion and

imports by USD 1673 billion in 2022.

|

Year |

Export |

Import |

|

2019 |

2051 |

2359 |

|

2020 |

1609 |

1635 |

|

2021 |

2552 |

2664 |

|

2022 |

4001 |

4337 |

***Value USD Billion

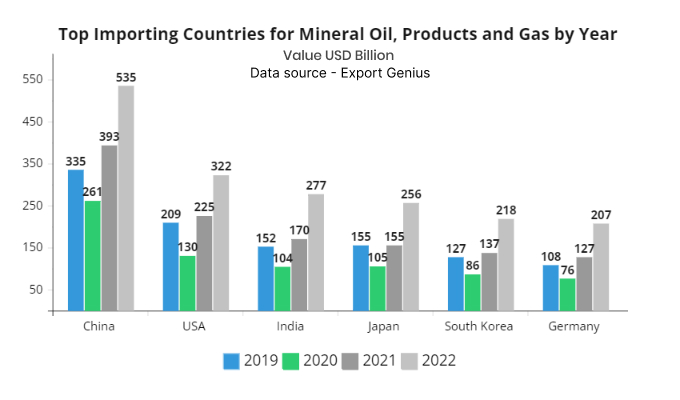

Top Importing Countries for

Crude Oil and Gas

From 2019 to 2022, the Oil and

Gas market witnessed both downward and upward trend. These fluctuating trends

remained the same for all top importing countries. For instance, China, the

USA, and India become the top importing countries from 2019 to 2022. In 2020,

the USA reduced its import of oil and gas by USD79 billion. However, in 2021,

China’s imports increased by USD 132 billion, this further accelerated to USD

142 in 2022. This year-on-year growth in import value shows the resilience of

the Chinese economy and the robust demand and supply.

|

Countries

Name |

2019 |

2020 |

2021 |

2022 |

|

China |

335 |

261 |

393 |

535 |

|

USA |

209 |

130 |

225 |

322 |

|

India |

152 |

104 |

170 |

277 |

|

Japan |

155 |

105 |

155 |

256 |

|

South Korea |

127 |

86 |

137 |

218 |

|

Germany |

108 |

76 |

127 |

207 |

***Value per USD Billion

Export-Import of Mineral

Fuels, Products and Gas

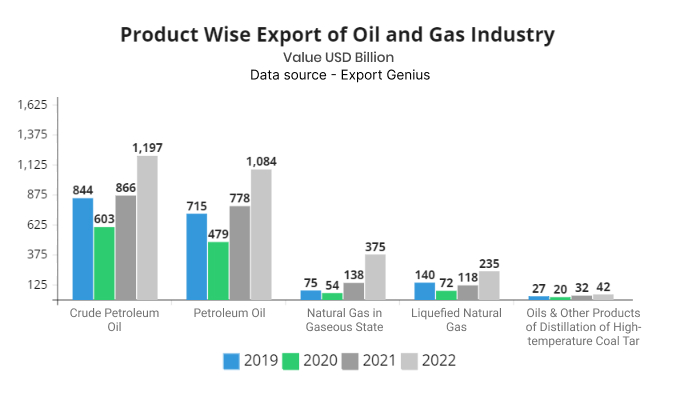

The total market value of

industry and top importing countries has extensively been covered with trade

data. Now, we will explore product-wise export and import patterns for the last

four years.

If we thoroughly go through

the table, then we find that Natural gas in a gaseous state increased by around

400% from 2019 to 2022. This drastic increase shows the exponential growth of

businesses in this sector across the globe. As per the market trend, growth in

the Gas industry will dominate the international market in the coming years as

the industries adopt the policy of carbon neutralisation. For complete trade

insights into exporting commodities, look at the table.

|

Product Name |

2019 |

2020 |

2021 |

2022 |

|

Crude Petroleum Oil |

844 |

603 |

866 |

1197 |

|

Petroleum

Oils and Oils Obtained from Bituminous Minerals |

715 |

479 |

778 |

1084 |

|

Natural Gas in Gaseous State |

75 |

54 |

138 |

375 |

|

Liquefied

Natural Gas |

140 |

72 |

118 |

235 |

|

Oils & Other Products of Distillation

of High-temperature Coal Tar |

27 |

20 |

32 |

42 |

***Value Billion USD

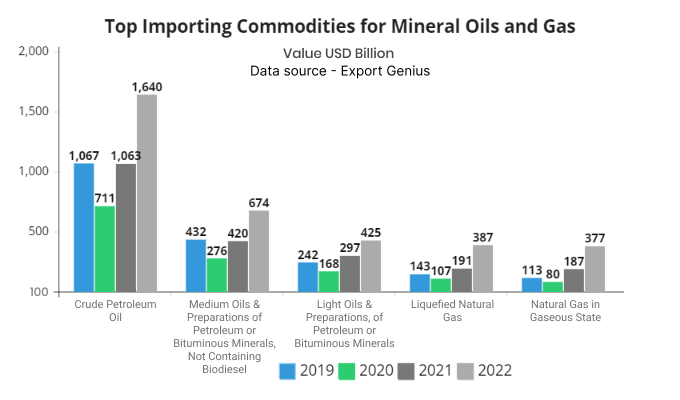

Import of Petroleum oils & oils obtained from bituminous minerals, crude

registered double-digit growth and increased by twofold from USD 711 In 2020 to

USD 1640 in 2022. On the other hand, the import of Natural gas in a gaseous

state increased from USD 113 Billion in 2019 to USD 377 billion in 2022, the

same goes with

|

Product Name |

2019 |

2020 |

2021 |

2022 |

|

Crude Petroleum Oil |

1067 |

711 |

1063 |

1640 |

|

Medium Oils & Preparations of Petroleum or Bituminous Minerals,

Not Containing Biodiesel |

432 |

276 |

420 |

674 |

|

Light Oils & Preparations, of Petroleum or Bituminous Minerals |

242 |

168 |

297 |

425 |

|

Liquefied

Natural Gas |

143 |

107 |

191 |

387 |

|

Natural Gas in Gaseous State |

113 |

80 |

187 |

377 |

***Value Billion USD

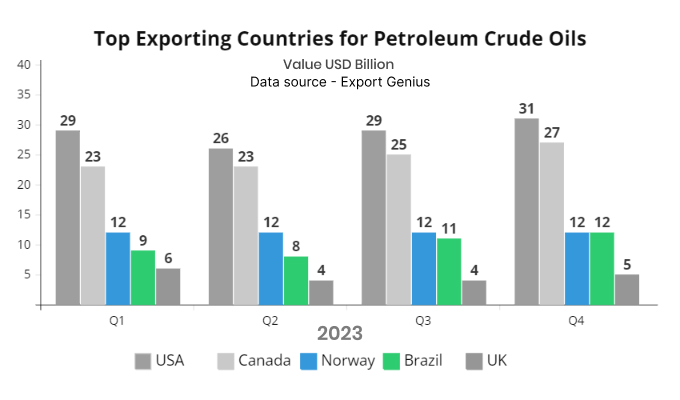

If we further go deep inside

the industry, then one may find that the USA and Canada become the largest

exporters of Petroleum oils and oils obtained from bituminous, minerals and

crude. The market of this commodity increased from USD 29 billion in Q1 to 31

billion in Q4 of 2023, whereas, export of the same commodity by the United

Kingdom took a downward trajectory from USD 6 billion in Q1 to 5 billion in Q4

of 2023. For more information, check the table.

|

Country

Name |

2023 |

|||

|

Q1 |

Q2 |

Q3 |

Q4 |

|

|

USA |

29 |

26 |

29 |

31 |

|

Canada |

23 |

23 |

25 |

27 |

|

Norway |

12 |

12 |

12 |

12 |

|

Brazil |

9 |

8 |

11 |

12 |

|

UK |

6 |

4 |

4 |

5 |

***Value Billion USD

Challenges face by Oils and

Gas Industry

As we have already discussed

the oil and Gas industry plays a crucial role in shaping the world economy, in

short, this industry is backbone of the economic activities. Despite the rapid

revenue growth, the industry is facing severe challenges in 2024. Here are some

of the challenges.

1.

Geopolitical Instability

Continuous

geopolitical tension between countries, for instance, Russia- Ukraine, Israel

Hamas, Red Sea disruption due to piracy attacks, China- Taiwan issue, etc. have

escalated the oil price across the globe. The average price of crude oil in

2020 increase from $39.68 to $76.30 per barrel in 2024.

2.

Energy needs with Environmental

Sustainability –

The

determination to make the world economy carbon neutral by 2050, adopted by some

advanced countries adversely affects the oil industry by focusing more on

natural gas and other source of energy, for instance, the European Green Deal,

etc.

3.

Technology

Disruption –

The

rapid advance of renewable energy, like solar energy, thermal power,

lithium-ion batteries, etc. with state-of-the-art technology poses severe

threats to fossil fuel-based industry.

4.

Strict Environmental laws and regulations

–

Governments

around the world are implementing the strictest laws to control and minimise

environmental damages, for instance, blending ethanol with petrol and diesel to

reduce pollutants.

5.

Volatile Market –

Fluctuation

in price is more frequent in this industry, due to this, businesses and

countries around the world are looking for a sustainable market in green energy

for lasting growth.

Opportunity In Oil and Gas

Industry

Now, explore how businesses

can take advantage of this wide industry with untapped opportunities.

1.

Natural Gas an Emerging Fuel –

Just

like crude oil, the demand for natural gas is accelerating worldwide and

covering the market share of more than USD 1.3 trillion. Businesses can

diversify their fossil-based industry to newly emerging markets.

2.

Investing In Carbon Capture and Storage

Business –

As the

Oil and Gas market is growing, the demand for carbon capture and storage is

also increasing. As per the reports, the market value will increase to USD 12.9

by 2030. This emerging market widens the scope for opportunity for newly

developed businesses.

3.

Rising Demand for LNG –

Demand

for Liquefied Natural Gas (LNG) drastically increased from USD 143 billion in

2019 to USD 387 billion in 2022 after geopolitical tension between countries.

Europe and Asia emerged as the key players in importing LNG from the world.

4.

Technology Advancement –

New

start-ups and entrepreneurs can explore the industry by entering with new

technologies, and artificial intelligence with advanced drillings to improve

efficiency, reduce costs and minimize the environmental impact.

5.

Discovering the New Market –

By

investing in research and development, industries can explore the untapped opportunities

in deep-sea mining, shale gas and others.

The mineral fuels, products

and gas industry is one of the most volatile markets, which fluctuates with

every international event. For businesses, it becomes crucial to enter the

industry with well-researched and constructive policies for lasting growth.