Asia’s Crude Oil Imports Hit Record High but China’s Oil Imports Decline

24 February 2023

Asia’s imports of crude oil reached a record high in

January 2023, but the strength wasn’t driven by China, with the world’s biggest

buyer actually recording a decline. According to a report, Asia’s total imports

of crude oil were 29.13 million barrels per day (bpd) in Jan 2023 from 26.22

million bpd reported in Dec 2022. China’s imports of crude oil were 10.98

million bpd in Jan 2023, down from 11.37 million bpd recorded a month before. The

decline resulted mainly from the early Lunar New Year holidays and the increasing

number of covid cases with the strict lockdown. Here is an overall analysis of the

Asian import market of crude oil with detailed information.

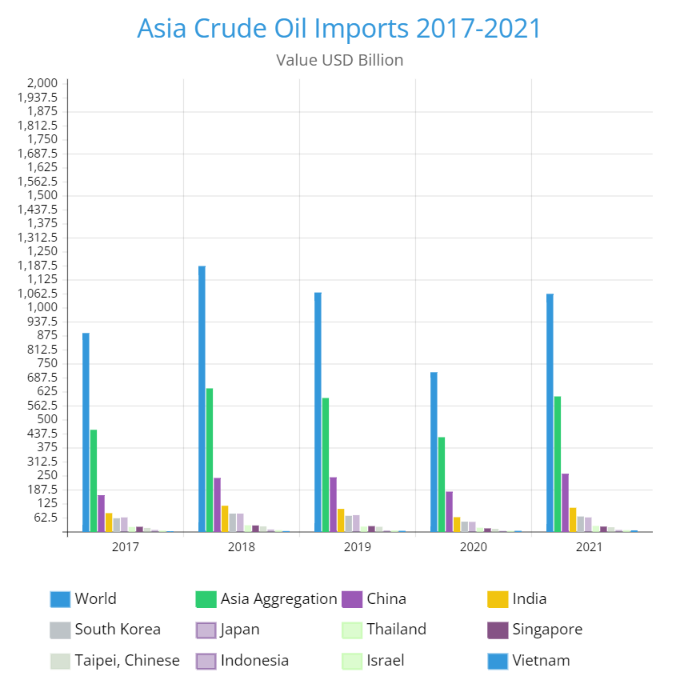

The Asian countries shared over 55% of the global imports of crude oil in 2021. China (24%) and India (10%) stood as the largest importers of oil in Asia. In the last five years, the demand for crude oil from China and India has risen, and reached a record high in 2022. The Russia-Ukraine war lead to sanctions on Russia from the European Union and other countries benefited India and China to get discounted crude oil from Russia. Here is a look at Asia’s crude oil imports from 2017 to 2021.

|

Year |

2017 |

2018 |

2019 |

2020 |

2021 |

|

World |

886 |

1,185 |

1,067 |

711 |

1,061 |

|

Asia Aggregation |

454 |

639 |

596 |

421 |

603 |

|

China |

162 |

239 |

242 |

178 |

258 |

|

India |

82 |

115 |

101 |

64 |

106 |

|

South Korea |

59 |

80 |

70 |

44 |

67 |

|

Japan |

63 |

80 |

73 |

43 |

63 |

|

Thailand |

20 |

28 |

22 |

17 |

25 |

|

Singapore |

21 |

27 |

24 |

14 |

22 |

|

Taipei, Chinese |

16 |

23 |

21 |

12 |

19 |

|

Indonesia |

7 |

9 |

5 |

3 |

7 |

|

Israel |

4 |

6 |

5 |

3 |

6 |

|

Vietnam |

0.6 |

2 |

3 |

3 |

5 |

*****Value USD Billion

According to a report, China’s crude oil imports will

come on track only from March 2023, and that is even dependent on several

factors. The first is whether the boost to travel, and thus fuel demand, seen

over the Lunar New Year is maintained, or whether large parts of China’s

population continue to hunker down at home now that the holidays have passed.

It’s likely that the Covid-19 pandemic will largely fade as a factor in China,

just as it has in other countries that have fully re-opened, but how quickly

fuel demand recovers and exceeds pre-pandemic levels is still uncertain.

Another factor is the price of crude oil and the

interplay between China’s inventories and its exports of refined products. China

has ramped up exports of fuels such as diesel and gasoline.

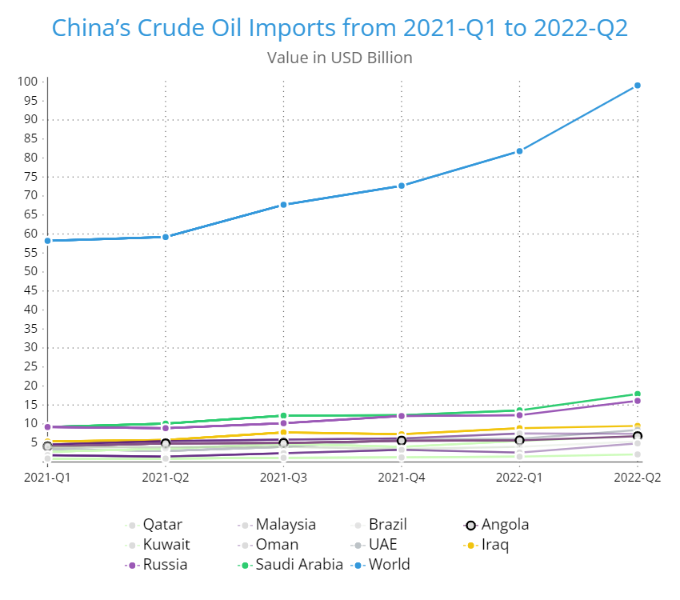

China is increasingly dependent on Russian crude oil, which is being sold at steep discounts as Moscow seeks to find new markets. This is after Western countries stopped buying oil as a result of sanctions and other measures imposed after Russia’s invasion of Ukraine on Feb 24 last year. According to a report, China imported 2.03 million bpd of oil from Russia in Jan 2023, up from 1.52 million bpd in December last year. Here is a look at China’s crude oil imports from 2021-Q1 to 2022-Q2.

|

Quarter |

2021-Q1 |

2021-Q2 |

2021-Q3 |

2021-Q4 |

2022-Q1 |

2022-Q2 |

|

World |

58.2 |

59.2 |

67.7 |

72.7 |

81.8 |

99.1 |

|

Saudi Arabia |

9.2 |

10.1 |

12.2 |

12.3 |

13.6 |

17.9 |

|

Russia |

9.2 |

8.9 |

10.2 |

12.1 |

12.3 |

16.1 |

|

Iraq |

5.4 |

5.8 |

7.8 |

7.3 |

8.9 |

9.5 |

|

UAE |

3.4 |

2.9 |

4.0 |

5.9 |

6.1 |

8.4 |

|

Oman |

4.6 |

5.5 |

5.9 |

6.2 |

7.5 |

7.4 |

|

Kuwait |

2.7 |

3.5 |

4.8 |

4.0 |

5.5 |

6.8 |

|

Angola |

4.1 |

4.9 |

5.0 |

5.6 |

5.7 |

6.8 |

|

Brazil |

3.9 |

3.9 |

4.0 |

3.4 |

4.0 |

5.4 |

|

Malaysia |

1.8 |

1.4 |

2.3 |

3.2 |

2.5 |

4.9 |

|

Qatar |

0.9 |

0.9 |

1.1 |

1.2 |

1.4 |

2.0 |

*****Value in USD Billion

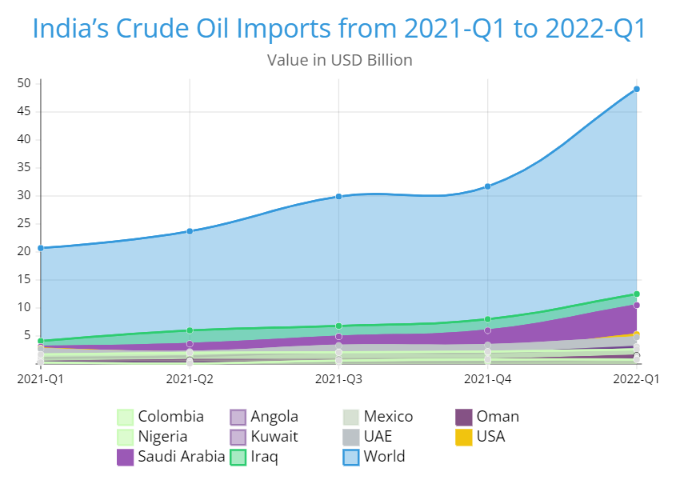

India, Asia’s second-largest importer, recorded arrivals of crude oil shipments (5.29 million bpd) in Jan 2023, up from December’s 4.78 million bpd. Russia maintained its position as top supplier of oil to India. Look at India’s imports of crude oil from 2021-Q1 to 2022-Q1.

|

Quarter |

2021-Q1 |

2021-Q2 |

2021-Q3 |

2021-Q4 |

2022-Q1 |

|

World |

20.7 |

23.7 |

29.9 |

31.7 |

49.1 |

|

Iraq |

4.1 |

6.0 |

6.8 |

8.0 |

12.5 |

|

Saudi Arabia |

3.1 |

3.6 |

4.9 |

6.0 |

10.5 |

|

USA |

2.8 |

2.1 |

2.9 |

2.5 |

5.3 |

|

UAE |

2.7 |

2.2 |

3.3 |

3.4 |

4.8 |

|

Kuwait |

1.1 |

1.4 |

2.1 |

2.0 |

3.1 |

|

Nigeria |

1.7 |

2.0 |

2.1 |

2.2 |

2.6 |

|

Oman |

0.4 |

0.7 |

0.7 |

0.8 |

1.5 |

|

Mexico |

0.6 |

0.6 |

1.0 |

1.0 |

0.9 |

|

Angola |

0.4 |

0.3 |

0.3 |

0.4 |

0.9 |

|

Colombia |

0.3 |

0.1 |

0.6 |

0.8 |

0.8 |

*****Value in USD Billion

According to a report, fuel demand in India increased

by 6.7% in October 2022 from the previous month. India’s crude oil imports were

at 4.69 million bpd, a four-month high, up from 4.24 million bpd in October.

India’s oil imports from Russia reached a record high of 1.0 million bpd,

making it the top supplier by surpassing the 960,000 bpd from Iraq.

The European Union’s ban on crude oil imports from

Russia came into effect on 5th December 2022, along with other

measures. The ban is aimed to make it harder for Russia, the world’s

second-biggest oil exporter to profit from its energy exports.

Although India and China, the world’s biggest and

third-largest crude oil importers haven’t signed up for such a ban, they may

find it difficult to continue to import at the hefty volumes of recent months

because of constraints with shipping capacity, financing, and insurance.