India’s Exports and Imports May Hit from the Ongoing Red Sea Crisis

14 February 2024

Main Highlights

Red Sea crisis impact on India’s trade which

accounts for 50% of the country’s exports and 30% of imports.

The demand for India’s basmati rice from the Middle

East, the United States and Europe is likely to hit.

Like basmati rice, chaos in the Red Sea is disrupting

shipments of other products as well including tea, spices, and buffalo meat.

Imports of fertilisers, sunflower oil,

machinery components and electronic goods are also likely to get disrupted from

the Red Sea attack.

India is facing an impact of the ongoing crisis around the Red Sea shipping route. The country is heavily reliant on the Red Sea route through the Suez Canal for its trade of goods with global regions, particularly Europe, North America, North Africa, and the Middle East. These regions accounted for about 50% of India’s exports and about 30% of imports. Let’s understand how Red Crisis may impact on India’s exports and imports of commodities.

Houthi rebels have been

carrying our missile and drone attacks on cargo ships in the Red Sea since

November, actions they say are in response to Israel’s war on Gaza. Retaliatory

strikes to aid the safe movement of ships by a US-led coalition have not stopped

the Houthi assaults.

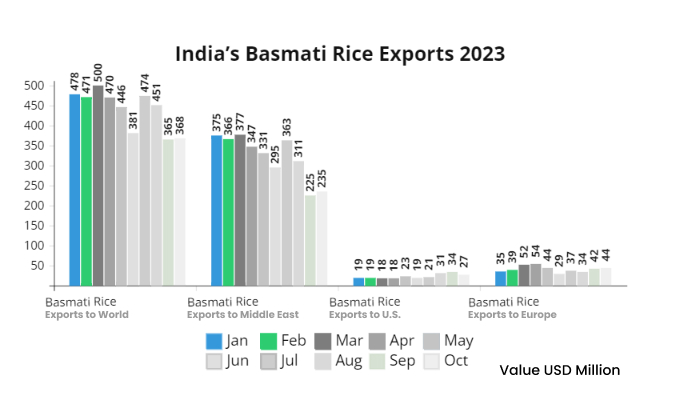

Demand for India’s basmati

rice from the Middle East, the United States and Europe

Demand for India’s basmati,

the long-grain aromatic rice, from traditional buyers in the Middle East, and

the United States has dropped in October 2023, however that from Europe

increased slightly in the same month. Overall, India’s exports of basmati rice

to the world declined in September and October of 2023. The reason is the

escalating tensions in the Red Sea, the shortest and most efficient trade route

for ships moving from Asia to Europe.

|

Month |

Basmati Rice Exports to World |

Basmati Rice Exports to Middle East |

Basmati Rice Exports to U.S. |

Basmati Rice Exports to Europe |

|

Jan |

478 |

375 |

19 |

35 |

|

Feb |

471 |

366 |

19 |

39 |

|

Mar |

500 |

377 |

18 |

52 |

|

Apr |

470 |

347 |

18 |

54 |

|

May |

446 |

331 |

23 |

44 |

|

Jun |

381 |

295 |

19 |

29 |

|

Jul |

474 |

363 |

21 |

37 |

|

Aug |

451 |

311 |

31 |

34 |

|

Sep |

365 |

225 |

34 |

42 |

|

Oct |

368 |

235 |

27 |

44 |

*******Value USD Million

India, the world’s biggest

rice exporter, ships more than 4.5 million tonnes of basmati rice to the world

annually. About 35% of about 7 million tonnes of production is exported to

Europe, North America, North Africa, and the Middle East through Red Sea.

Attacks by Iranian-backed

Houthis from Yemen on commercial vessels passing through the Red Sea have

forced shippers to avoid one of the world’s most crucial trade routes. The

alternative longer route around the Cape of Good Hope on the southern tip of

Africa has added more than 3,500 nautical miles (6,500 km) to the journey and

close to a half-month of sailing time to each trip, significantly increasing

shipping coasts.

Indian exporters of basmati

rice face challenges in shipping as freight costs have shot up as high as five

times with an increase in insurance premiums, shortage of containers and longer

transit time. According to a report, some companies have kept their inventories

at various ports or processing units and others have sold in the domestic

market, resulting in a fall in prices by about 8% in the local market.

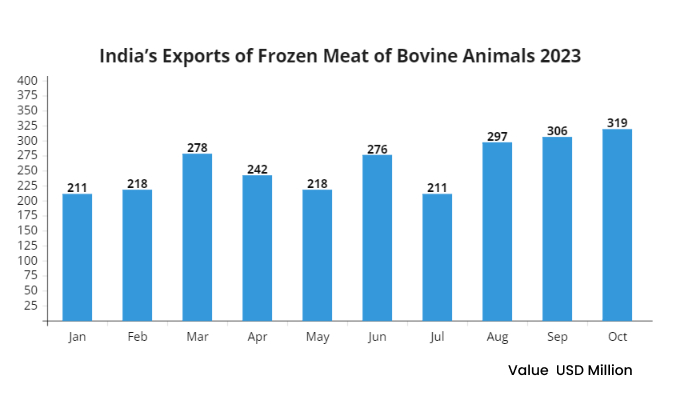

India’s exports of other

commodities also hurt from Red Sea crisis

Like basmati rice, chaos in

the Red Sea is disrupting shipments of other products as well including tea,

spices, and buffalo meat. This has raised concern that the unrest will lead to

supply chain disruptions and contraction of trade, and halt a slowdown in food

inflation.

India’s buffalo meat export is

hurt from the Red Sea crisis. The country is one of the leading buffalo meat

exporters. About 60% of India’s shipments go through the Red Sea to North

African countries and Russia.

|

Month |

Value USD Million |

|

Jan |

211 |

|

Feb |

218 |

|

Mar |

278 |

|

Apr |

242 |

|

May |

218 |

|

Jun |

276 |

|

Jul |

211 |

|

Aug |

297 |

|

Sep |

306 |

|

Oct |

319 |

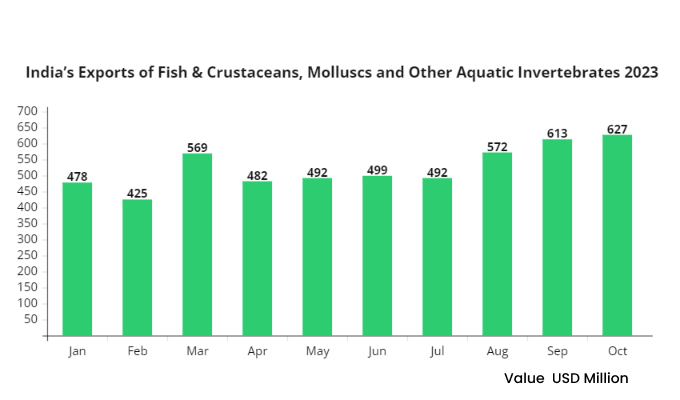

Similarly, marine items

including shrimps and prawns can also see a significant impact as around 80% of

the production is exported, and over half of it through the Red Sea. Their

perishable nature and lean margins make exporters vulnerable to increasing freight

costs and competitive pressure from Latin American suppliers.

|

Month |

Value USD Million |

|

Jan |

478 |

|

Feb |

425 |

|

Mar |

569 |

|

Apr |

482 |

|

May |

492 |

|

Jun |

499 |

|

Jul |

492 |

|

Aug |

572 |

|

Sep |

613 |

|

Oct |

627 |

India’s imports also disrupted

due to Red Sea attack

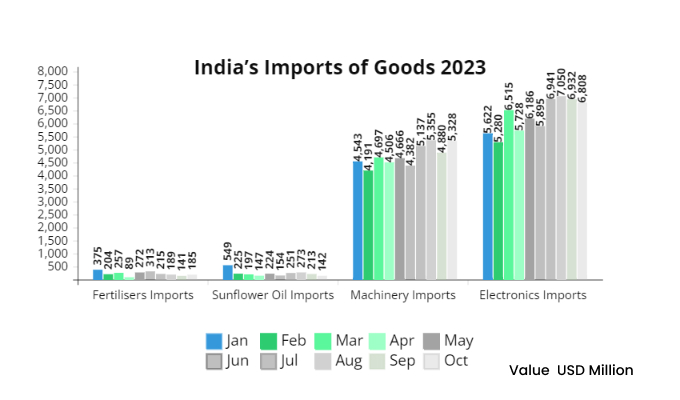

Imports of fertilisers,

sunflower oil, machinery components and electronic goods are also likely to get

disrupted from the Red Sea attack. The supply of sunflower oil has become tight

for India, the world’s biggest importer of the vegetable oil. As most of the

vessels from Russia and Ukraine are being rerouted through the Cape of Good

Hope, freight costs have increased by 35% and transit time increased by 15

days. Similarly, shipments of fertilisers have been delayed and logistics costs

have risen.

|

Month |

Fertilisers Imports |

Sunflower Oil Imports |

Machinery Imports |

Electronics Imports |

|

Jan |

375 |

549 |

4,543 |

5,622 |

|

Feb |

204 |

225 |

4,191 |

5,280 |

|

Mar |

257 |

197 |

4,697 |

6,515 |

|

Apr |

89 |

147 |

4,506 |

5,728 |

|

May |

272 |

224 |

4,666 |

6,186 |

|

Jun |

313 |

154 |

4,382 |

5,895 |

|

Jul |

215 |

251 |

5,137 |

6,941 |

|

Aug |

189 |

273 |

5,355 |

7,050 |

|

Sep |

141 |

213 |

4,880 |

6,932 |

|

Oct |

185 |

142 |

5,328 |

6,808 |

*****Value USD Million

However, there is no

disruption in oil flows even as the Red Sea is one of the key routes for oil

shipments for India which imports around 80% of its crude oil needs. Russia

emerged as one of the biggest crude oil suppliers to India in 2023, accounting

for more than one-third of its imports. According to a report, unlike other

sectors, there is no diversion of Russian vessels carrying crude oil bound for

India through the Red Sea.

Exports from Kolkata port, a

gateway to eastern India, are facing challenges including government’s rice

export ban, geopolitical tension, and skyrocketing ocean freight costs. As a

result, the trade activities are likely to get slow. Freight charges have gone

up since December last year due to the escalating conflict in the Red Sea,

forcing Indian exporters to halt their shipments.