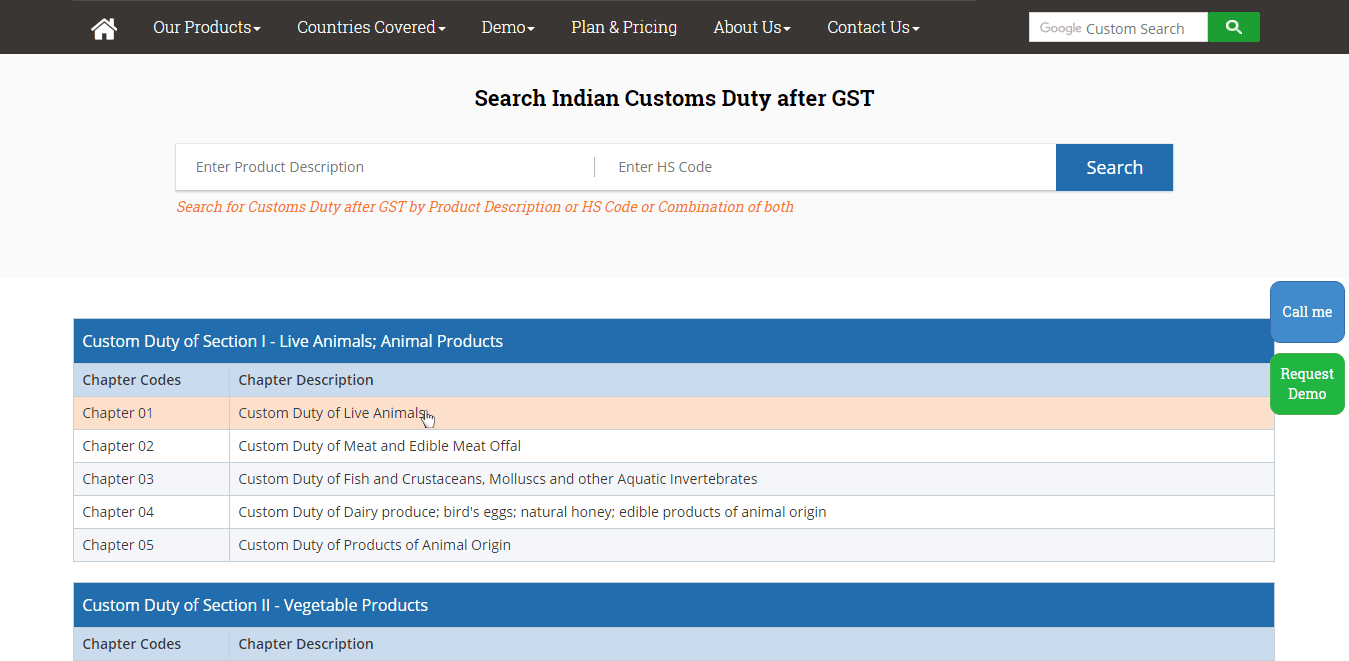

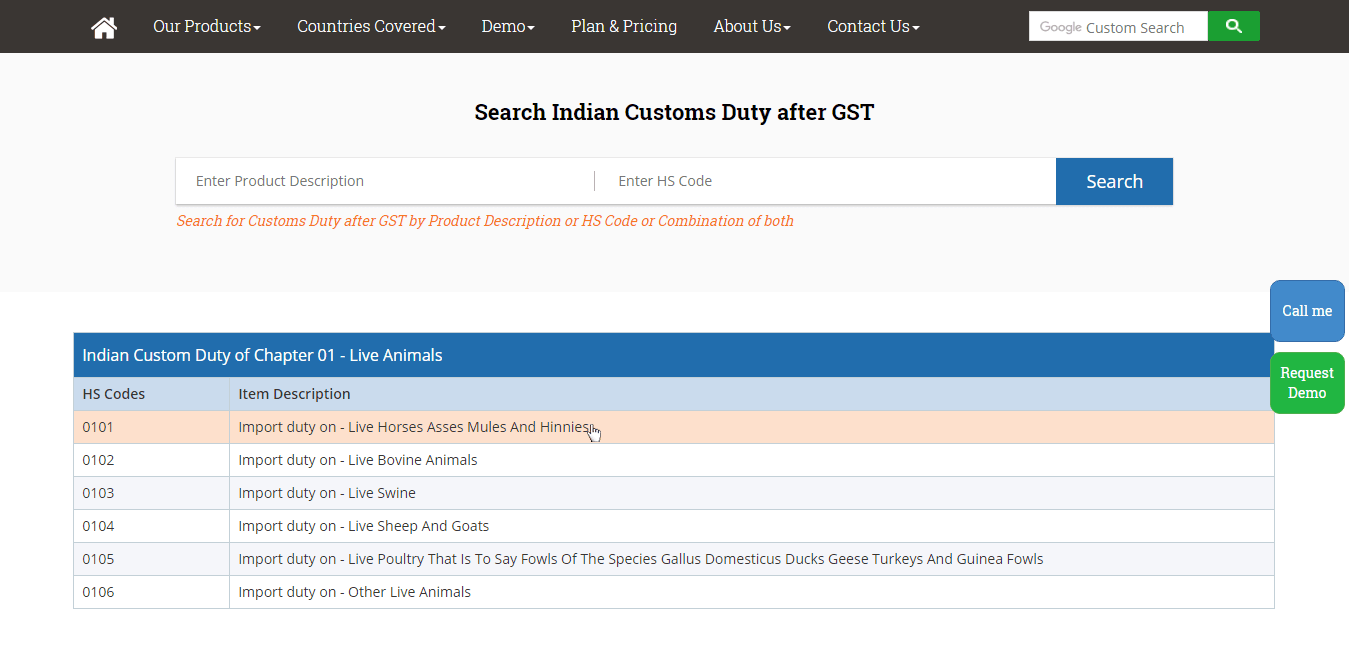

Under GST regime, there are two main import duties – Basic Custom Duty (BCD) and Integrated Goods and Services Tax (IGST). However, additional import duties like Compensation Cess, Safeguard Duty and Anti-Dumping Duty are levied on some goods. Let’s understand them one by one:

- Basic Custom Duty :

BCD is a specific type of import duty, which is levied on value of goods imported into India from other countries. It is charged as usual after GST.

- Integrated Goods and Services Tax :

IGST is a new type of tax under GST regime, which is levied on goods imported into India from other countries. Basically, the tax is collected when goods

- Compensation Cess :

Compensation Cess is levied on certain goods such as pan-masala, cigarettes, etc. in order to provide compensation to the states for loss of revenue due to implementation of Goods and Services Tax (GST).

- Safeguard Duty :

Safeguard Duty is other type of custom duty, which is levied on goods when sudden rise in imports of any product has caused serious problem to the domestic industries.

- Anti-Dumping Duty :

Anti-dumping duty is a tariff, levied by government on goods that are believed to be dumped in national market. Basically, dumping is a process where a company exports a commodity at a price lower than the price it normally charges on its own home market.