Russia-Ukraine War – Surging Oil Prices Impact Inflation across Asia

17 March 2022

Crude oil’s relentless surge due to Russia’s invasion

of Ukraine threatens to stoke inflation across Asia. The rising inflation rates

are forcing central banks to decide whether to create a tighter policy against

higher prices or hold off amid the blow of economic growth. As a net importer

of energy goods, Asia is vulnerable to the surge in oil prices triggered by the

ongoing Russia-Ukraine war.

Here are some facts and stats related to how the crude

oil surge is impacting Asia’s biggest economies:

China – world’s largest crude oil

importer

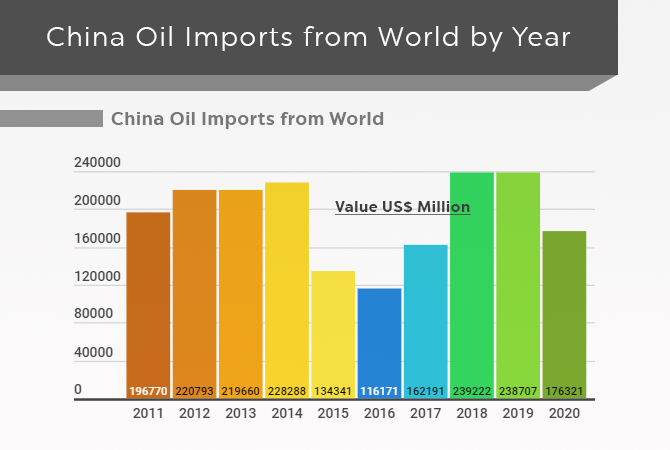

China, the world’s largest crude oil importer, is

facing a squeeze on companies’ profits and consumer spending power, as well as

slower demand, complicating Beijing’s effort to stabilize a slowing economy. China

imported crude oil worth US$176,321 million in 2020. Here’s a year-wise

analysis of China oil imports from the world.

|

Year |

China Oil Imports from World

(Value US$ Million) |

|

2011 |

196,770 |

|

2012 |

220,793 |

|

2013 |

219,660 |

|

2014 |

228,288 |

|

2015 |

134,341 |

|

2016 |

116,171 |

|

2017 |

162,191 |

|

2018 |

239,222 |

|

2019 |

238,707 |

|

2020 |

176,321 |

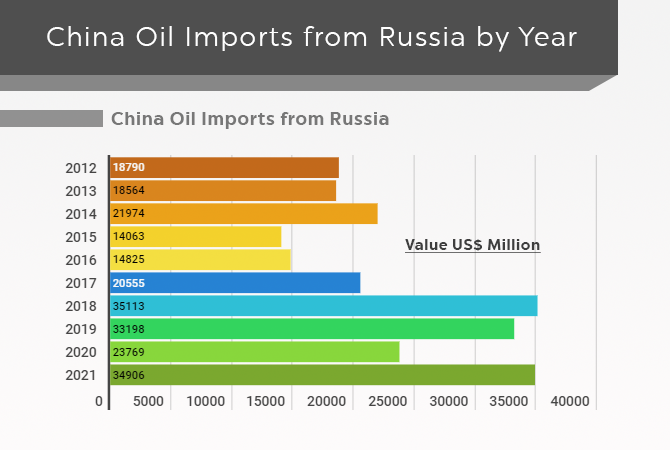

China is the top destination of Russian oil exports accounting

for 31.7% of the total value of shipments in 2021. If we yearly trends of

China’s imports of Russian oil, we found that the value of oil shipments from

Russia has increased in the last ten years. Below given chart shows the dollar

amount of China oil imports from Russia from 2012 to 2021.

|

Year |

China Oil Imports from

Russia (Value US$ Million) |

|

2012 |

18,790 |

|

2013 |

18,564 |

|

2014 |

21,974 |

|

2015 |

14,063 |

|

2016 |

14,825 |

|

2017 |

20,555 |

|

2018 |

35,113 |

|

2019 |

33,198 |

|

2020 |

23,769 |

|

2021 |

34,906 |

Japan – Inflation could rise

The rising crude oil prices have also increased inflation in Japan as well. According to industry experts, the inflation rate in Japan could hit 2% briefly, and rise further toward summer, but it’s unlikely to stay at 2% stably. Japan imported crude oil worth US$62,807 million in 2021. Saudi Arabia and the United Arab Emirates are the biggest oil suppliers to Japan, together contributing over 75% to total Japan oil imports. Here is a list of Japan’s top 5 oil import partners with their share in values reported in 2021.

|

Country |

Value US$ % |

|

Saudi Arabia |

40 |

|

United Arab Emirates |

34.7 |

|

Kuwait |

8.5 |

|

Qatar |

7.4 |

|

Russia |

3.7 |

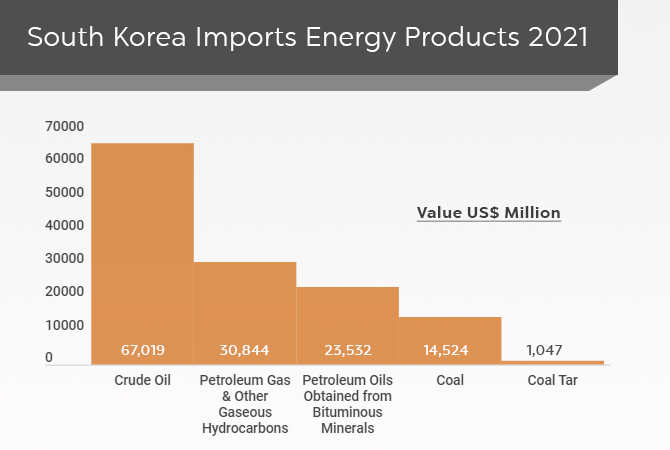

South Korea – Costs of energy

products will increase

South Korea is also worried about the costs of energy

products in the international market due to Russia’s invasion of Ukraine. The

South Korean manufacturing industries rely heavily on imports for energy and

the country only just returned to a surplus in trade in February 2022 after a

two-month caused by high oil prices. Here are major energy goods which South

Korea imported in 2021.

|

Product |

Value US$ Million |

|

Crude Oil |

67,019 |

|

Petroleum Gas & Other Gaseous

Hydrocarbons |

30,844 |

|

Petroleum Oils Obtained from Bituminous

Minerals |

23,532 |

|

Coal |

14,524 |

|

Coal Tar |

1,047 |

Other than Asia, Australia is expected to have little

impact of rising crude oil prices on its economy. The country is a major

exporter of liquefied natural gas, shipments of which hit a record high in 2021

driven by a surge in energy demand and prices. According to the economists,

Australia could see a boost to export revenue, national income, and economy. For

a complete review, we have to see in which direction the Russia-Ukraine war

goes and how the world would take up the rising prices of crude oil and other

commodities.