No Deal Brexit Impact on UK Import Export – Understand UK Trade Data

30 December 2020

Britain and the European Union are seeking a

post-Brexit trade deal, with failure likely to impact UK’s imports &

exports. This would also result to increased chaos in mutual trade between UK

and European Union countries, financial markets tumbling and huge economic

costs. Brexit withdrawal agreement was officially signed on 24th

January 2020. A no-deal Brexit is the potential withdrawal of the UK from the

EU without a withdrawal agreement. Let’s discuss more about no deal Brexit and

its impact on UK import & export from Export

Genius UK trade data and business intelligence reports.

What is a No-Deal Brexit?

With the Dec 31, 2020, deadline for a trade agreement between

the European Union and the United Kingdom approaching, the risk of a “no-deal

Brexit is mounting. When the U.K. initiated Brexit its exit from the EU on 31st

Jan 2020, the Withdrawal Agreement provided 11 months for negotiating a new

trade relationship between U.K. and EU during the transition. If no deal is

reached by the deadline, it will trigger what called a no-deal Brexit. That

means the UK-EU trade relationship will be governed, by default, by the trading

rules of the World Trade Organization

(WTO).

How it will impact on UK economy?

Industries such as manufacturing, financial services

and agriculture would be hammered by no deal, which would wipe 2% off the UK’s

economic output on top of the hit caused by Covid-19 pandemic. According to

intelligence reports, the consequences of no deal are severe and the spread of

the novel coronavirus has only increased the importance of agreeing a deal.

How will this affect specific

sectors?

The effect of a no-deal Brexit and its new regulatory

hurdles won’t be evenly distributed. They would hit some sectors much harder

than others. The new trade barriers are particularly concerning to the

agricultural sector, automobile industry and manufacturing sector.

While the EU’s average MFN tariff rate on commodities

is 3.2%, tariffs on some U.K. goods would be significantly higher. EU tariffs on

imports on an average would be 11.1% on agricultural commodities. According to

market research data, EU tariffs can reach 189% on some dairy products and 116%

on animal products.

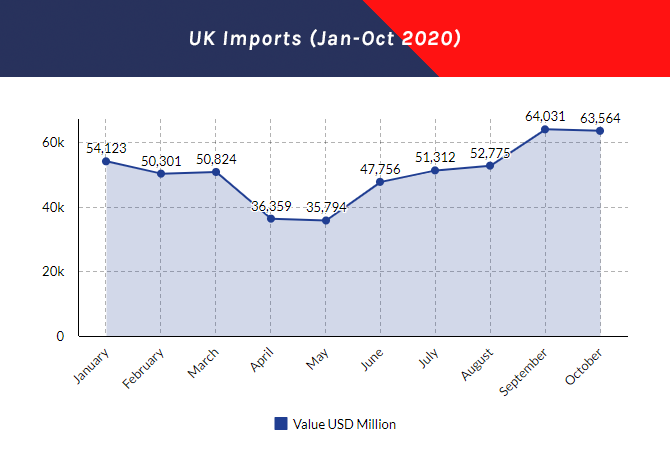

UK Imports (Jan-Oct 2020)

Based on UK import

data and shipping details, the value of UK’s imports started falling

drastically from March to May 2020, when novel coronavirus spread rapidly and

country went into lockdown. June month saw some recovery after some relaxation

and opening of industries. From July to October 2020, import value of total

commodities increased as the United Kingdom imported goods from other

countries. Below given chart shows dollar amount of UK’s imports recorded from

Jan to Oct 2020.

|

Month |

Value USD Million |

|

January |

54,123 |

|

February |

50,301 |

|

March |

50,824 |

|

April |

36,359 |

|

May |

35,794 |

|

June |

47,756 |

|

July |

51,312 |

|

August |

52,775 |

|

September |

64,031 |

|

October |

63,564 |

UK Exports (Jan-Oct 2020)

Our UK export

data shows that from Feb to Jun 2020, the value of total goods exported

fell drastically amid Covid-19 pandemic and lockdown. The United Kingdom

recorded an increase in export value from Jul to Oct 2020, when the country

started recovering from the virus and economy. See chart below to analyze

actual picture of UK exports from Jan to Oct 2020.

|

Month |

Value USD Million |

|

January |

36,953 |

|

February |

35,101 |

|

March |

34,992 |

|

April |

29,232 |

|

May |

26,602 |

|

June |

29,740 |

|

July |

31,855 |

|

August |

30,104 |

|

September |

32,828 |

|

October |

36,806 |

To some extent, financial markets have already priced

in a no-deal Brexit. If a deal is struck, stocks may rise. However, the

short-term effects of a no deal Brexit may be hard to analyze because of the

significant negative impact of the Covid-19 pandemic.